Global Resource Wars: 5 Critical Conflicts Shaping Our World

Explore global resource conflicts shaping geopolitics. From Arctic oil to rare earths, discover how nations compete for vital resources. Learn about diplomacy's role in conflict resolution. #ResourceConflicts #Geopolitics

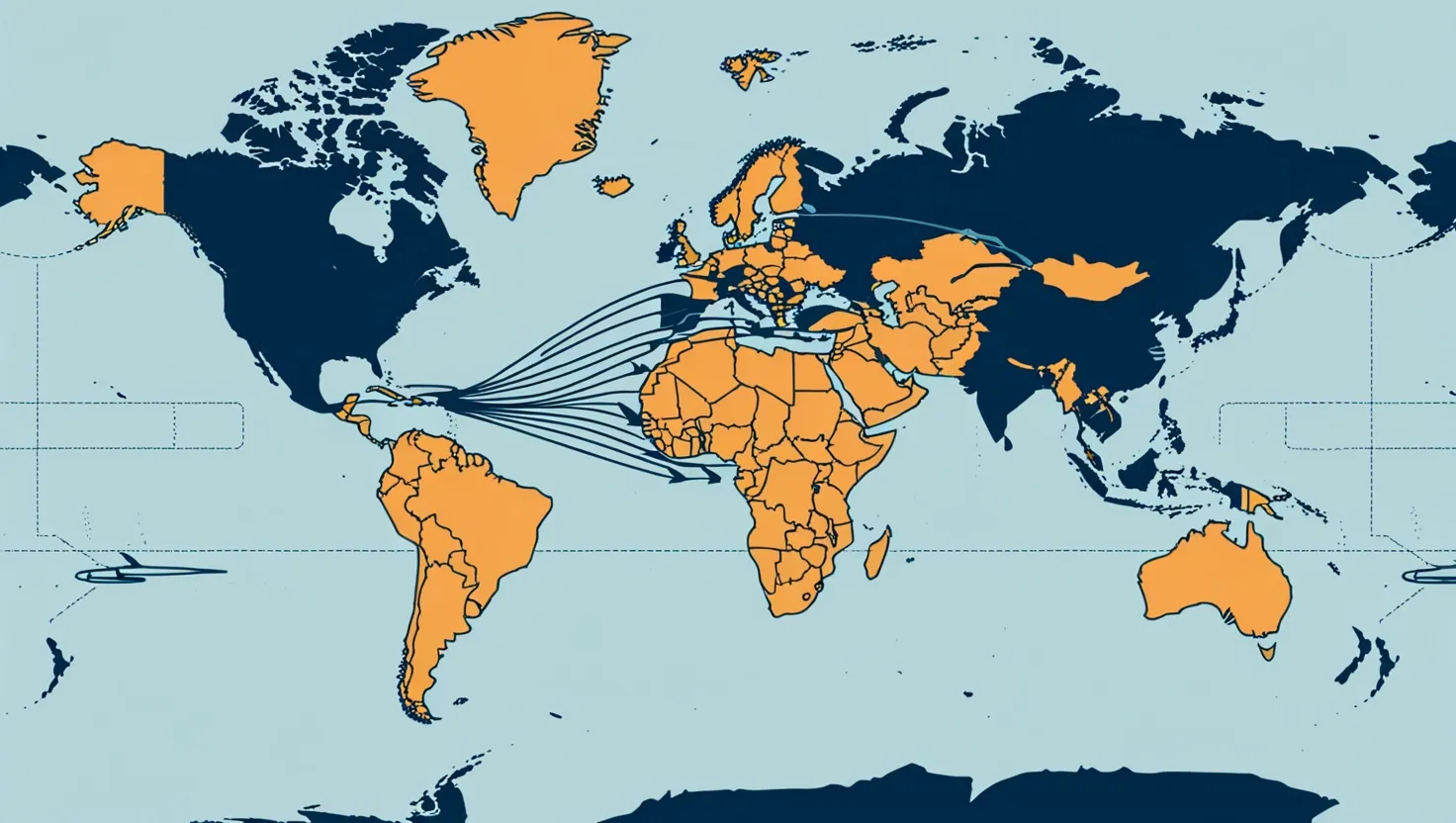

Global Debt Relief: Strategies for Economic Freedom and Sustainable Development

Explore global debt relief initiatives: HIPC, MDRI, Paris Club, and COVID-19 responses. Understand their impact, challenges, and the future of sustainable economic development. Learn more now.

5 Groundbreaking Fintech Innovations Reshaping Global Finance

Explore 5 fintech innovations reshaping finance: blockchain payments, AI credit scoring, open banking, robo-advisors, and embedded finance. Learn their impact on banking and consumers.

Global Trade Disputes: Navigating Conflicts and Economic Impacts

Explore the impact of global trade disputes on economies, industries, and consumers. Learn about key conflicts, their consequences, and potential solutions for a stable global market.

Global Demographic Shifts: Reshaping Economies and Societies in 2023

Explore the global demographic shifts reshaping economies, societies, and politics. Learn about aging populations, youth bulges, and urbanization trends. Discover policy responses and future impacts.

Global Water Crises: 6 International Disputes Shaping World Politics

Explore 6 global water crises shaping international relations. Learn how water scarcity impacts diplomacy, economics, and the environment. Discover solutions for sustainable water management.

Global Energy Transitions: Reshaping Economies and Geopolitics

Explore the global energy transition: renewable rise, nuclear resurgence, hydrogen economy, and storage innovations. Discover economic impacts and geopolitical shifts shaping our future. Learn more.

Global Food Crisis 2025: Navigating Climate, Conflict, and Rising Prices

Discover the urgent challenges threatening global food security in 2025. Learn about climate change impacts, water scarcity, and potential solutions. Act now for a sustainable future.

Global Currency Trends: Reshaping International Trade and Economic Power

Explore global currency trends shaping international trade. Learn about digital currencies, yuan's rise, dollar's challenges, and their impact on businesses and economies. Click for insights.

Top 5 Sovereign Wealth Funds Shaping Global Finance: Strategies and Impact

Explore the impact of top sovereign wealth funds on global finance. Learn how Norway, China, UAE, Kuwait, and Singapore shape investment trends and economic policies. Discover their strategies and challenges.

Tax Havens: Global Impact on Wealth Distribution and Economic Fairness

Explore the impact of tax havens on global economics. Discover how these jurisdictions affect wealth distribution, tax revenues, and economic equality. Learn about reform efforts and ethical implications.

5 Game-Changing Trade Agreements Transforming Global Commerce

Explore 5 trade agreements reshaping global commerce. Learn how RCEP, USMCA, AfCFTA, EU-Japan, and CPTPP impact economies, market access, and geopolitics. Discover the future of international trade.

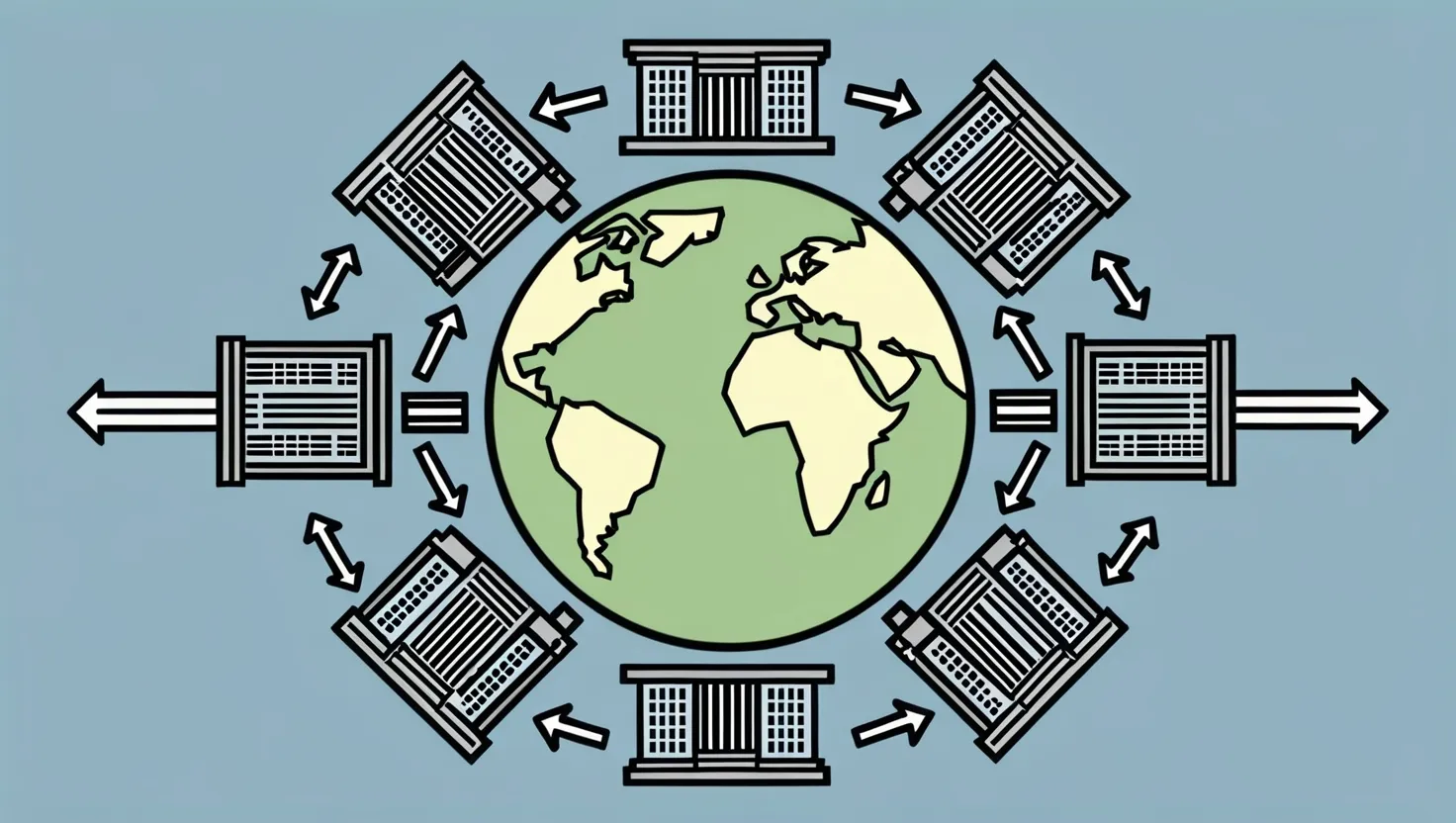

Global Financial Powerhouses: 7 Key Institutions Shaping World Development

Explore the crucial roles of international financial institutions in global development. Discover how they shape economies, fund projects, and address global challenges. Learn more about their impact.