Unearthing Hidden Gems: The Art of Spotting Undervalued Stocks

Ever feel like you're always late to the party when it comes to investing? Like all the good stocks have already been snatched up by the time you hear about them? Well, buckle up, because we're about to dive into the world of hidden gems in the stock market.

You know those tiny acorns that grow into massive oak trees? That's what we're talking about here. Small-cap value stocks, the underdogs of the investing world, can pack a serious punch if you know where to look. These little companies, worth between $250 million and $2.5 billion, often fly under the radar. But man, when they take off, it's like watching a rocket launch.

Take ACM Research, for example. This semiconductor equipment maker is riding the tech wave like a pro surfer. With crazy growth numbers - we're talking 42.7% expected EPS growth and 45.4% sales growth over five years - it's a hidden treasure just waiting to be discovered. And get this: its forward P/E ratio is only 13.3. That's like finding a designer bag at a thrift store price.

But wait, there's more! Ever heard of Titan Machinery? No? Well, you might want to pay attention. These guys are in the agricultural and construction equipment biz, and with all the infrastructure projects popping up, they're set to plow through some serious barriers. We're looking at 25% EPS growth and 15.2% sales growth over five years. And hold onto your hats, because their forward P/E ratio is a mind-blowing 5.0. Talk about undervalued!

Now, let's chat about Stride. Remember when everyone suddenly started learning online during the pandemic? Well, Stride was right there, ready to cash in. And they're still going strong, with 20% EPS growth and 14.3% sales growth expected. Their forward P/E of 12.2 suggests there's still room for this stock to stretch its legs.

Oh, and have you heard about the Internet of Things? It's not just a buzzword, it's big business. That's where Digi International comes in. These guys are all about IoT solutions, and with 17% EPS growth and 14.1% sales growth on the horizon, they're definitely worth a look. Their forward P/E of 11.7 is pretty sweet too.

Now, let's talk housing. NMI Holdings is riding the wave of the housing boom like a pro surfer. As more folks aim for that picket fence dream, NMIH's fortunes keep rising. With 14.5% EPS growth and 17.3% sales growth expected, and a forward P/E of just 6.7, this stock is practically begging to be noticed.

And hey, tax season might be a pain for most of us, but for H&R Block, it's payday. This financial service stock is seriously undervalued and ready to run. Plus, with a total yield of 2.81%, it's like getting paid to wait for the stock to take off.

Now, you might be thinking, "Nintendo? Hidden gem? Come on!" But hear me out. Despite being a household name, Nintendo's financial strength is often overlooked. They're sitting on a mountain of cash, which means they're ready for whatever the economy throws at them. And that 2.81% total yield? It's like finding extra coins in Super Mario.

In the world of healthcare, Medtronic is the quiet achiever. They've been a bit flat lately, but 2024 is looking bright. They just reported a 6% revenue bump, and they're diving into AI with Nvidia. Plus, with a 3.57% dividend yield, it's like getting a health bonus with your investment.

Pure Storage might seem like an odd choice, given its recent price jumps. But here's the thing - some folks think it hasn't grown enough. Their skepticism could be your golden ticket. The company's killing it with earnings, but worries about competition have some analysts nervous. Still, the overall price target is higher than where it's at now. Smell that? It's opportunity.

Last but not least, we've got 2seventy bio. This little biotech company is punching way above its weight. With a market cap of just $206 million, they've already got revenue coming in - that's rare for a company this size. They've got FDA approval for their cellular therapy, Abecma, and they're making moves towards profitability. Some analysts are skeptical, but that could mean this stock is ripe for the picking.

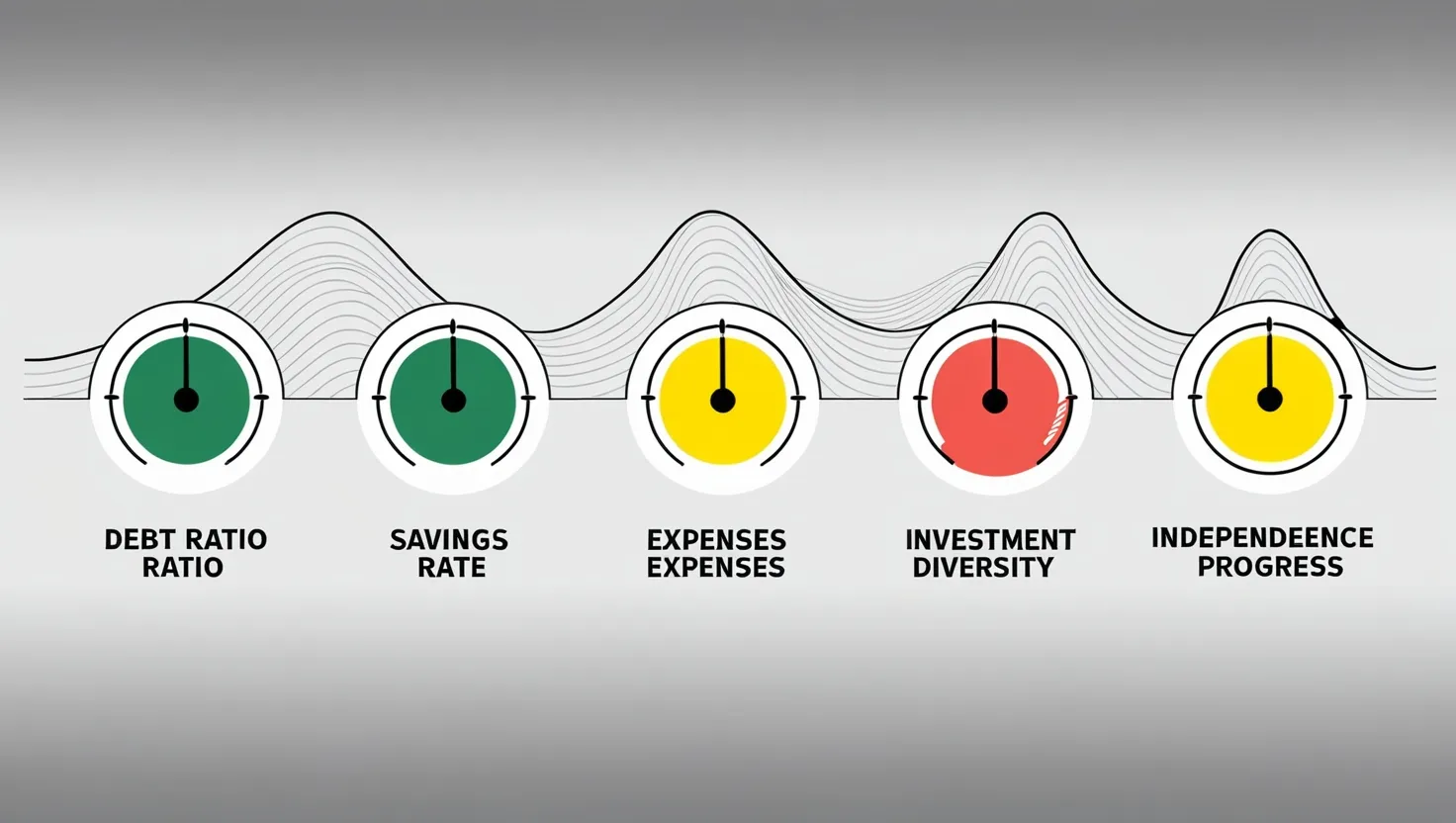

Now, finding these hidden gems isn't just about luck. It's about rolling up your sleeves and digging into the numbers. You've gotta look at stuff like earnings growth, sales trends, and those juicy P/E ratios. It's about spotting the diamonds in the rough before everyone else does.

But here's the thing - investing in these underdogs can be a bit of a rollercoaster ride. Small-cap stocks can be as unpredictable as a cat on catnip. That's why you've gotta spread your bets. Don't put all your eggs in one basket, you know?

At the end of the day, investing in hidden gems is a bit like planting a garden. You've gotta have patience, keep an eye on things, and trust in the process. These stocks might not explode overnight, but give 'em time, and they could grow into something beautiful.

So, next time you're scrolling through stock tickers, don't just focus on the big names. Look for the little guys with big potential. Who knows? You might just stumble upon the next Amazon or Google before they hit the big leagues.

Remember, in the world of investing, sometimes the best treasures are hidden in plain sight. Happy hunting, folks!