Unlocking Hidden Profits: The Art of Special Situation Investing

Ever thought you needed to be a Wall Street whiz to make it big in stocks? Think again. There's a secret weapon that even average Joes can use to rake in serious cash - it's called special situation investing.

So what's the deal with special situations? Picture this: You're at a yard sale, and buried under a pile of junk, you spot a rare vintage watch. While everyone else is fighting over the shiny new stuff, you've found a hidden gem. That's kinda what special situation investing is like in the stock market.

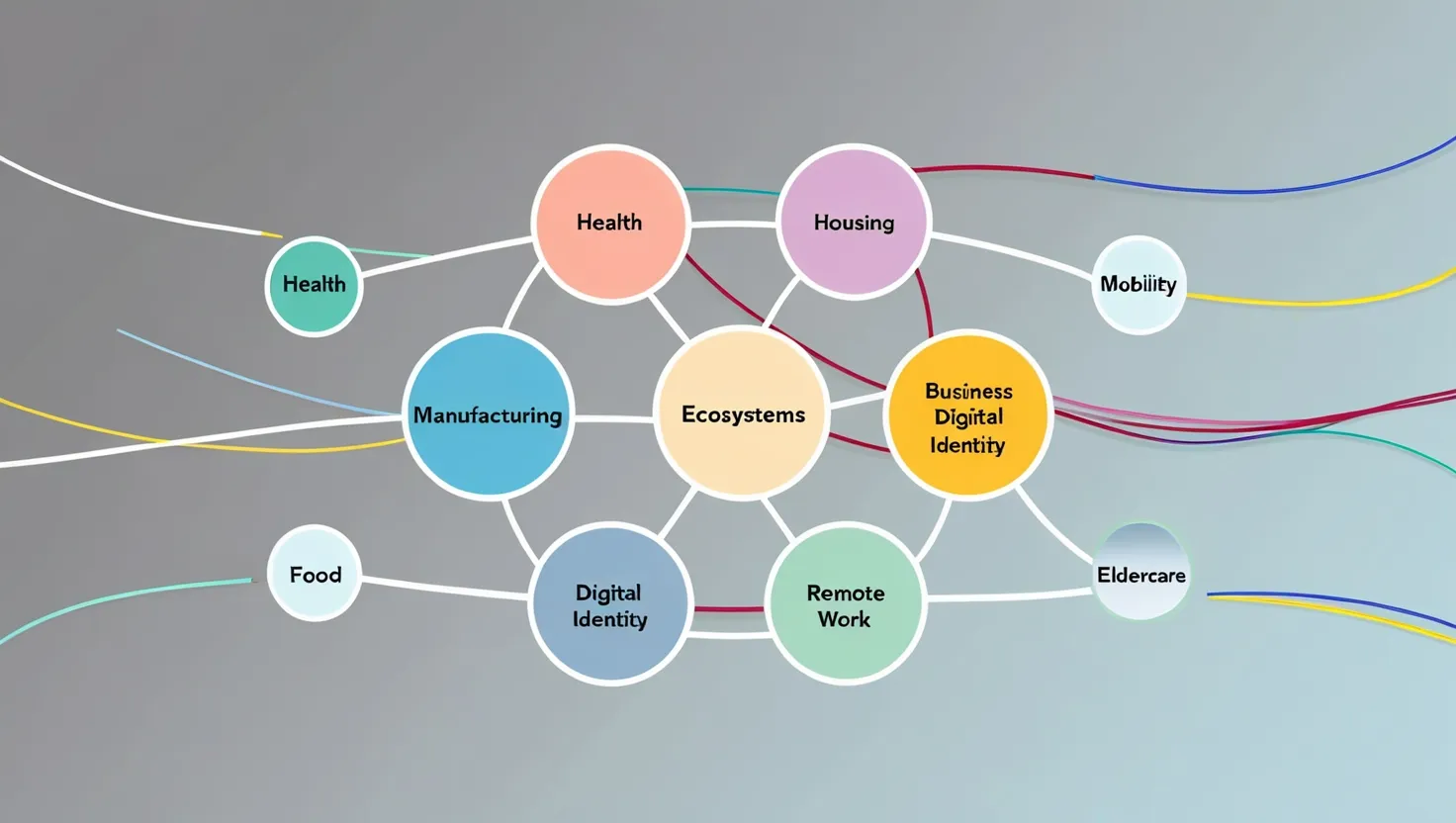

These special situations pop up when companies go through big changes. We're talking spin-offs, mergers, restructurings - the works. Most folks don't pay attention to this stuff, but that's where the real money is hiding.

Let's break it down with some examples. Remember when Philip Morris International split from Altria? That was a golden opportunity. The new company was like a newborn calf - wobbly at first, but ready to run. If you'd jumped on that, you'd be sitting pretty now.

Or how about when DuPont spun off its chemical division to create Dow Inc.? That was like watching a butterfly emerge from its cocoon. The new company was leaner, meaner, and ready to soar. Savvy investors who spotted this chance laughed all the way to the bank.

Now, you might be thinking, "Sounds great, but how do I spot these opportunities?" Don't sweat it, it's not rocket science. First off, keep your ear to the ground. Follow business news, especially stuff about companies splitting up or joining forces. It's like being the first to know about a big sale - you gotta be in the loop.

Next, pay attention to what the bigwigs are doing. If the head honchos of a new spin-off company are buying up shares like there's no tomorrow, that's a good sign. It's like the captain of a ship betting his life savings on the voyage - you know he believes in where it's heading.

Now, here's where it gets a bit nerdy, but stick with me. There's this thing called the Magic Formula. No, it's not some Harry Potter spell. It's a simple way to find companies that are cheap but super profitable. You look at two things: how much the company's earning compared to its price (that's the P/E ratio) and how good they are at making money from what they've got (that's ROIC). Find a company that scores well on both, and you might just have struck gold.

But hey, don't put all your eggs in one basket. Spread your bets around. It's like going to a buffet - you don't just pile your plate with one dish, right? Same deal with investing. Try a bit of this, a bit of that. That way, if one investment goes south, you're not totally screwed.

Now, let's talk about some other special situations that can make you rich. Ever heard of merger arbitrage? Sounds fancy, but it's pretty simple. When two companies decide to get hitched, their stock prices usually do a little dance. The company being bought often sees its stock go up, while the buyer's stock might dip a bit. If you're smart, you can make money on this price difference. It's like buying something on sale and selling it for full price - ka-ching!

And don't forget about companies going through tough times. Yeah, I know, sounds crazy to invest in a company that's struggling. But here's the thing - sometimes, these companies come out the other side stronger than ever. Take General Motors, for example. They went bankrupt, but then came back like a phoenix from the ashes. Investors who had the guts to buy in when things looked grim made a killing.

Now, I'm not saying this is easy money. You gotta do your homework. Don't just take some hot tip from your buddy at the bar. Dig in, do your own research. It's like being a detective - you're looking for clues that others might miss.

And here's a pro tip: focus on a few good opportunities rather than trying to chase every shiny object. It's better to know a lot about a few things than a little about everything. Think quality over quantity.

Patience is key too. These special situations don't always pay off overnight. Sometimes you gotta wait it out. It's like planting a tree - you don't dig it up every day to check if it's growing. You water it, give it time, and before you know it, you've got a mighty oak.

Let me tell you about some folks who've struck it rich with this strategy. There was this guy who bought into News Corp when it split from 21st Century Fox. He saw the potential in the new media company before anyone else did. Now he's probably sipping margaritas on his own private island.

Or how about the smart cookies who made bank on the Exxon-Mobil merger? They played both sides, buying one stock and selling the other short. When the dust settled, they were laughing all the way to the bank.

The bottom line is this: you don't need to be a Wall Street hotshot to make serious money in stocks. You just need to know where to look and have the guts to go after opportunities that others miss. Special situation investing is like finding treasure in your own backyard - it's there if you know how to spot it.

So next time you hear about a company splitting up or merging, don't just shrug it off. Take a closer look. You might just stumble onto your own little gold mine. Who knows? With a bit of smarts and a dash of courage, you could be the next stock market genius. And the best part? You don't need an Ivy League degree or a fancy suit to do it. Just a keen eye for opportunity and the willingness to take a chance.

Remember, in the stock market, it's not always the biggest or the loudest that win. Sometimes, it's the quiet observer who spots the hidden gem that everyone else overlooked. So keep your eyes peeled, do your homework, and don't be afraid to dive in when you spot a good opportunity. Who knows? The next big special situation could be your ticket to financial freedom. Happy hunting!